Now let’s take a look at what other ways John could be able to save money if the interest rate is still at 6.5%. When he took the loan at 7%, his monthly payment was $2,661.21, and when he refinanced, it was at $2,475.05, which was $186.15 less per month. If he decides to pay this extra amount towards his mortgage, he could significantly reduce the principal balance of his loan faster than scheduled. This approach not only shortens the loan term but also slashes the total interest he’ll pay over the life of the mortgage. It’s a smart move for anyone looking to achieve financial freedom sooner, assuming that he continues to stay for the longer term and the rate remains constant at the same rate.

Using the loan amortization schedule, here’s how much John would save by making the extra payment:

| Month | Base Monthly Payment | Extra Payment | Total Payment | Principal Payment | Interest Payment | Remaining Balance | Cumulative Interest |

|---|---|---|---|---|---|---|---|

| 1 | $2,475.05 | $186.15 | $2,661.20 | $540.14 | $2,121.06 | $391,039.65 | $2,121.06 |

| 2 | $2,475.05 | $186.15 | $2,661.20 | $543.07 | $2,118.13 | $390,496.58 | $4,239.19 |

| 3 | $2,475.05 | $186.15 | $2,661.20 | $546.01 | $2,115.19 | $389,950.57 | $6,354.38 |

| 4 | $2,475.05 | $186.15 | $2,661.20 | $548.97 | $2,112.23 | $389,401.60 | $8,466.61 |

| 5 | $2,475.05 | $186.15 | $2,661.20 | $551.94 | $2,109.26 | $388,849.66 | $10,575.87 |

| … | … | … | … | … | … | … | … |

| 295 | $2,475.05 | $186.15 | $2,661.20 | $2,643.97 | $17.23 | $536.89 | $394,011.28 |

| 296 | $2,475.05 | $186.15 | $2,661.20 | $533.98 | $2.91 | 0 | $394,014.19 |

John will only pay for 296 months instead of 360 months. So the total cumulative interest for the entire 30 years comes to $394,014.19.

If John did not make those extra payments, the total cumulative interest would have been $499,438.44, so it is a fabulous savings of $105,424.25 which includes early payment savings of $54,914.25

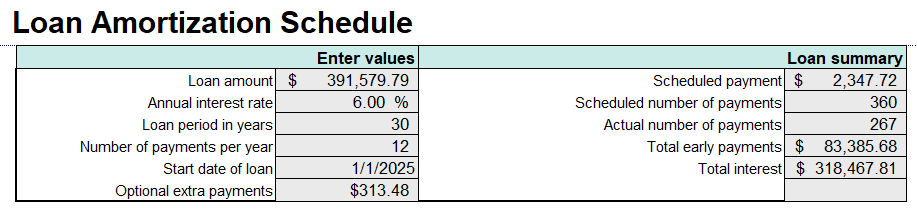

If the interest rate was 6.0% instead of 6.5%, below would be the savings if John still made the same monthly payment of $2661.20 that included additional monthly payments.

| Month | Base Monthly Payment | Extra Payment | Total Payment | Principal Payment | Interest Payment | Remaining Balance | Cumulative Interest |

|---|---|---|---|---|---|---|---|

| 1 | $2,347.72 | $313.48 | $2,661.20 | $703.30 | $ 1,957.90 | $ 390,876.49 | $1,957.90 |

| 2 | $2,347.72 | $313.48 | $2,661.20 | $706.82 | $1,954.38 | $390,169.67 | $3,912.28 |

| 3 | $2,347.72 | $313.48 | $2,661.20 | $710.35 | $1,950.85 | $389,459.32 | $5,863.13 |

| 4 | $2,347.72 | $313.48 | $2,661.20 | $713.90 | $1,947.30 | $388,745.42 | $7,810.43 |

| 5 | $2,347.72 | $313.48 | $2,661.20 | $717.47 | $1,943.73 | $388,027.95 | $9,754.15 |

| … | … | … | … | … | … | … | … |

| 266 | $2,347.72 | $313.48 | $2,661.20 | $2,637.22 | $23.98 | $2,157.96 | $318,457.02 |

| 267 | $2,347.72 | $313.48 | $2,661.20 | $2,147.17 | $10.79 | 0 | $318,467.81 |

John will only pay for 267 months instead of 360 months. So the total cumulative interest for the entire 30 years comes to $318,467.81.

If John did not make those extra payments, the total cumulative interest would have been $499,438.44, so it is a fabulous savings of $180,970.63 which includes early payment savings of $83,385.68