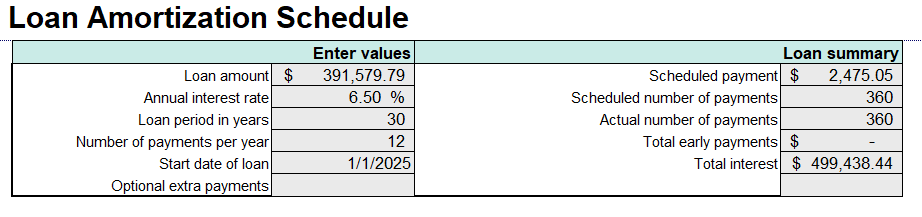

John is considering refinancing the remaining balance of $391,579.79 and he is getting the interest rate of 6.5% for another 30 years. Now Let’s see what happens!

New Loan Amount: $391,579.79 (remaining balance from the original loan)

Interest Rate: 6.5%

Loan Term: 30 years

Monthly payment = $2,475.05

Monthly Payments

| Details | Original Loan |

|---|---|

| Loan Amount | $391,579.79 |

| Interest Rate | 6.5% |

| Loan Term | 30 years |

| Monthly Payment | $2,475.05 |

Using a loan amortization schedule, if John continued with the above monthly payments, the total interest paid would be $449,438.44

Amortization Table Summary

Below are snapshots of the amortization schedules for the first 2 years of the second loan:

Refinanced Loan (6.5%)

| Month | Payment | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | 2475.05 | 2121.06 | 353.99 | 391,225.80 |

| 2 | 2475.05 | 2119.14 | 355.91 | 390,869.89 |

| 3 | 2475.05 | 2117.21 | 357.84 | 390,512.05 |

| … | … | … | … | … |

| 23 | 2475.05 | 2076.38 | 398.67 | 382,933.92 |

| 24 | 2475.05 | 2074.23 | 400.83 | 382,533.09 |

The above table illustrate how much of each monthly payment goes toward interest and principal, along with the remaining balance. The refinanced loan has a slightly smaller payment.

Let’s break down the total interest John’s payments in both scenarios.

Scenario 1: Stick with Original Loan (7%)

- Total payments (30 years): $2,661.21 × 360 = $958,035.60

- Total interest: $958,035.60 – $400,000 = $558,035.60

Scenario 2: Refinance at 6.5%

- Total payments for the first 2 years: $2,661.21 × 24 = $63,869.04 (i.e. total interest of 55,448.83 and principal of 8,420.21)

- Remaining loan refinanced at 6.5%: $2,475.05 × 360 = $891,018.00

- Total payments: $63,869.04 + $891,018.00 = $954,887.04

- Total interest: $954,887.04 – $400,000 = $554,887.04

Savings from Refinancing

- Interest Saved: $558,035.60 – $554,887.04 = $3,148.56

- Lower Monthly Payment: $2,661.21 – $2,475.05 = $186.15 less per month

Even though John paid $186.15 less per month for 360 months, he can only be able to save a maximum of $3,148.56 when we combine the total payments made in the first and second loans. When we include closing costs (e.g., application fees, appraisal), which can range from 2–5% of the loan amount in the refinance calculation, there will be no significant savings at all. Refinancing for a slightly lower rate (7% to 6.5%) and resetting the term to 30 years increases the total interest paid over the life of the loan, even though monthly payments are lower.

In order to save money through refinancing, John can either wait till the interest rate drops to 6.00% or pay some extra or additional amount on top of regular monthly payments.

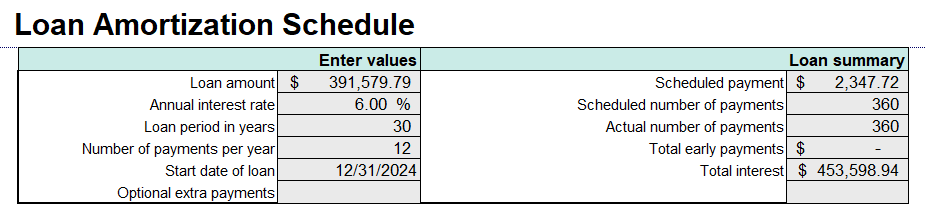

Lets look at the same above scenario if John would have waited till the rate dropped to 6.0%.

New Loan Amount: $391,579.79 (remaining balance from the original loan)

Interest Rate: 6.0%

Loan Term: 30 years

Monthly payment = $2,347.72

Monthly Payments

| Details | Original Loan |

|---|---|

| Loan Amount | $391,579.79 |

| Interest Rate | 6.0% |

| Loan Term | 30 years |

| Monthly Payment | $2,347.72 |

Using a loan amortization schedule, if John continued with the above monthly payments, the total interest paid would be $453,598.94

Amortization Table Summary

Below are snapshots of the amortization schedules for the first 2 years of the second loan:

Refinanced Loan (6.0%)

| Month | Payment | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | 2,347.72 | 1,957.90 | 389.82 | 391,189.97 |

| 2 | 2,347.72 | 1,955.95 | 391.77 | 390,798.20 |

| 3 | 2,347.72 | 1,953.99 | 393.73 | 390,404.47 |

| … | … | … | … | … |

| 23 | 2,347.72 | 1,912.69 | 435.03 | 382,103.12 |

| 24 | 2,347.72 | 1,910.52 | 437.20 | 381,665.91 |

The above table illustrate how much of each monthly payment goes toward interest and principal, along with the remaining balance. The refinanced loan has a slightly smaller payment.

Let’s break down the total interest John’s payments in both scenarios.

Scenario 1: Stick with Original Loan (7%)

- Total payments (30 years): $2,661.21 × 360 = $958,035.60

- Total interest: $958,035.60 – $400,000 = $558,035.60

Scenario 2: Refinance at 6.0%

- Total payments for the first 2 years: $2,661.21 × 24 = $63,869.04 (i.e. total interest of 55,448.83 and principal of 8,420.21)

- Remaining loan refinanced at 6.0%: $2,347.72 × 360 = $845,179.2

- Total payments: $63,869.04 + $845,179.2 = $909,048.24

- Total interest: $909,048.24 – $400,000 = $509,048.24

Savings from Refinancing

- Interest Saved: $558,035.60 – $509,048.24 = $48,987.36

- Lower Monthly Payment: $2,661.21 – $2,475.05 = $313.49 less per month

In this scenario, John is able to save significantly, about 48,987.36, if he continues to live in the house throughout the loan term. Now let’s explore the scenario in case the interest rate was still hovering around 6.5% for a longer period. what could John do in case he wants to save money as part of refinancing. Let’s see that in Part-3.